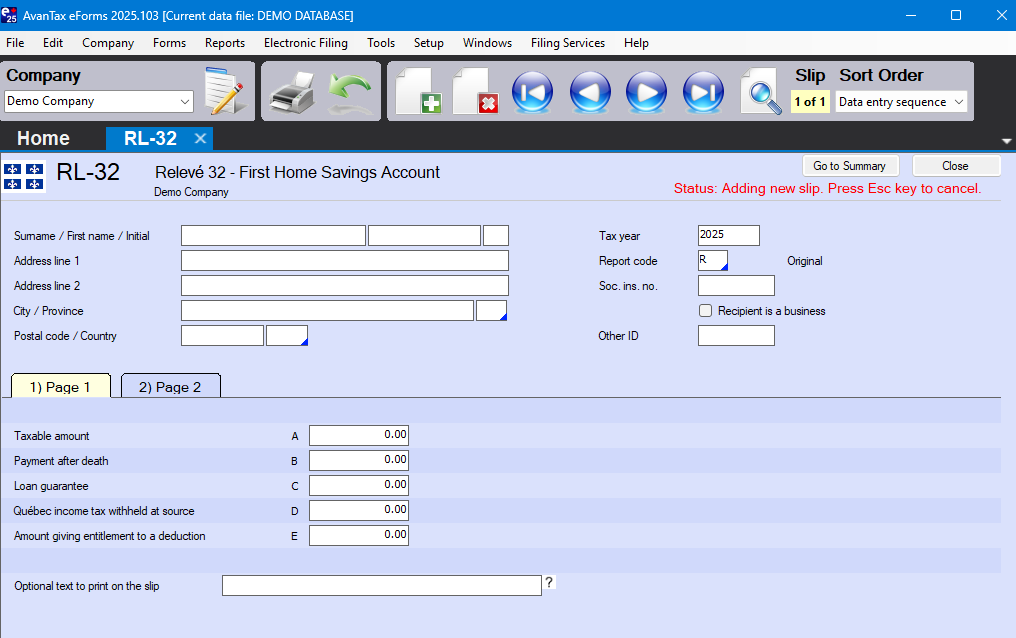

Relevé 32 (RL-32) - First Home Savings Account (FHSA)

Relevé 32 is available as an add-on module for AvanTax eForms Enterprise.

Here's how the AvanTax eForms software can help you prepare your Relevé 32 return:

- User friendly Relevé 32 data entry

- Import Relevé 32 data from CSV, Excel, or Revenu Québec XML submission file*

- Print Relevé 32 slips and summaries on plain paper or Revenu Québec forms

- Create individual Relevé 32 slips (password protected PDF) for electronic distribution**

- Distribute recipient Relevé 32 slips by email or corporate portal**

- Prepare Relevé 32 XML files and upload over Revenu Québec's Internet File Transfer portal

- Easily process original, amended, cancelled and additional Relevé 32 returns

- PLUS!

- Roll forward previous year Relevé 32 data into current year

- Roll forward current year Relevé 32 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

The RL-32 slip is used by first home savings account (FHSA) issuers to report taxable amounts allocated to FHSA holders or beneficiaries.

FHSA holders and beneficiaries use the information from the RL-32 slip to complete the personal income tax return (TP-1-V).