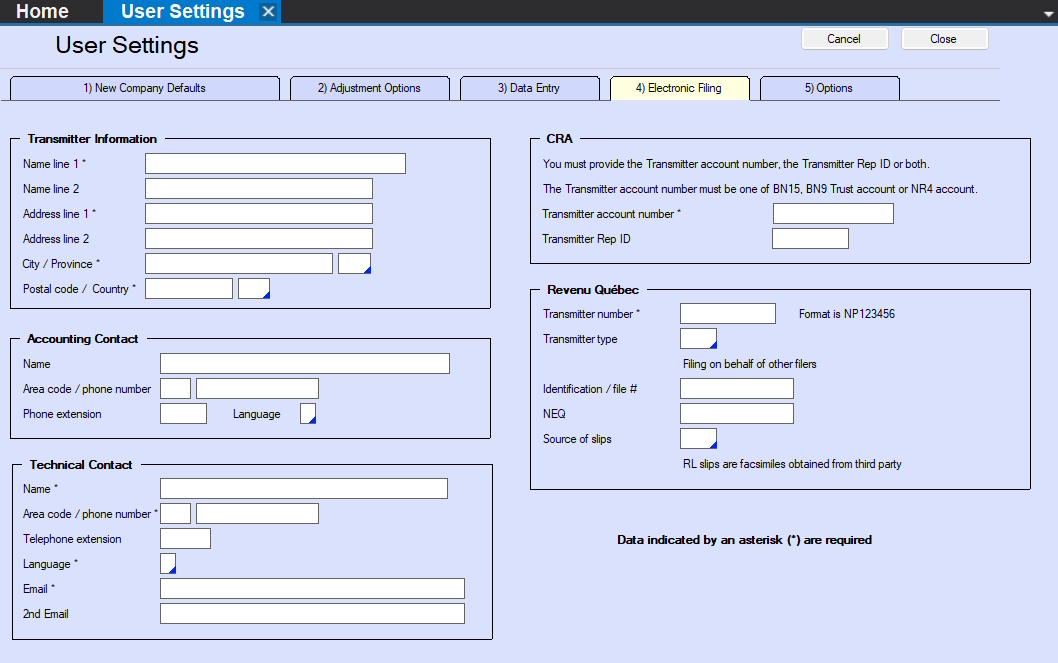

Electronic Filing

From the Home Screen use: User Setup > User Settings > Electronic Filing

From the Menu use: Setup > User Settings > Electronic Filing

User Settings - Electronic Filing

NOTE: Items marked with an astersik are required.

Transmitter Information section - This section contains the contact information of the Transmitter of the XML submission, NOT the company to which this data belongs.

Accounting Contact section - This section contains the contact information for the accounting contact for the data being submitted; CRA or Revenu Québed may contact this individual if the XML file has accounting issues..

Technical Contact section - This section contains the contact information for the technical contact for the data being submitted; CRA or Revenu Québed may contact this individual if the XML file has technical issues.

CRA section - This section contains the transmitter account information for the Transmitter of the XML submission, NOT the company to which this data belongs.

- The Transmitter Account Number or Rep ID entered here MUST identical to what will be used to access the CRA filing portal.

- Enter EITHER the Transmitter Account Number OR the Rep ID OR BOTH.

- The Transmitter Account Number can be one of:

- 15 character Business Number

- 9 character Business Number

- Trust Account Number

- NR4 Account Number

Revenu Québec section - This section contains the transmitter account information for the Transmitter of the XML submission, NOT the company to which this data belongs.

- Transmitter Number - Enter the 8 character number assigned to the Transmitter by Revenu Québec

- Transmitter Type - Select the appropriate Transmitter type from the drop-down list.

- Identification / file # - The 16 character Business Number assigned to the Transmitter by Revenu Québec.

- NEQ - The 10 digit numerical identifier assigned to the Transmitter.

- Source of slips - Select the source of slips from the drop-down list.