TP-600 / Relevé 15 (RL-15) - Partnership Information Return

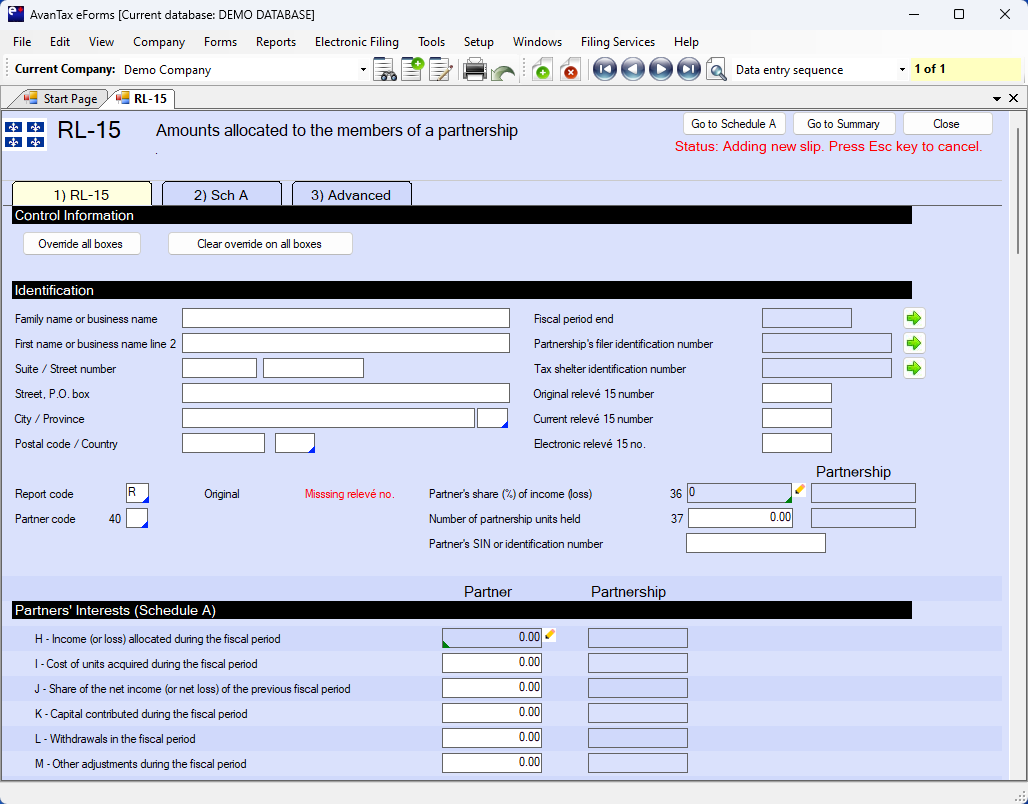

Here's how the AvanTax eForms software can help you prepare your Relevé 15 return:

- Includes Schedules A, B, C, D & E

- User friendly Relevé 15 data entry

- Import Relevé 15 data from CSV, Excel, or Revenu Québec XML submission file*

- Print Relevé 15 slips and summaries on plain paper or Revenu Québec forms

- Create individual Relevé 15 slips (password protected PDF) for electronic distribution**

- Distribute recipient Relevé 15 slips by email or corporate portal**

- Prepare Relevé 15 XML files and upload over Revenu Québec's Internet File Transfer portal

- Easily process original, amended, cancelled and additional Relevé 15 returns

- PLUS!

- Roll forward previous year Relevé 15 data into current year

- Roll forward current year Relevé 15 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

The Relevé 15 slip must be completed by any partnership required to report the income, deductions and other amounts it allocates among its members.

The information on the Relevé 15 slip is used by a member of a partnership to complete the personal income tax return; form CO-17, Déclaration de revenus des sociétés; form TP-600-V, Partnership Information Return.