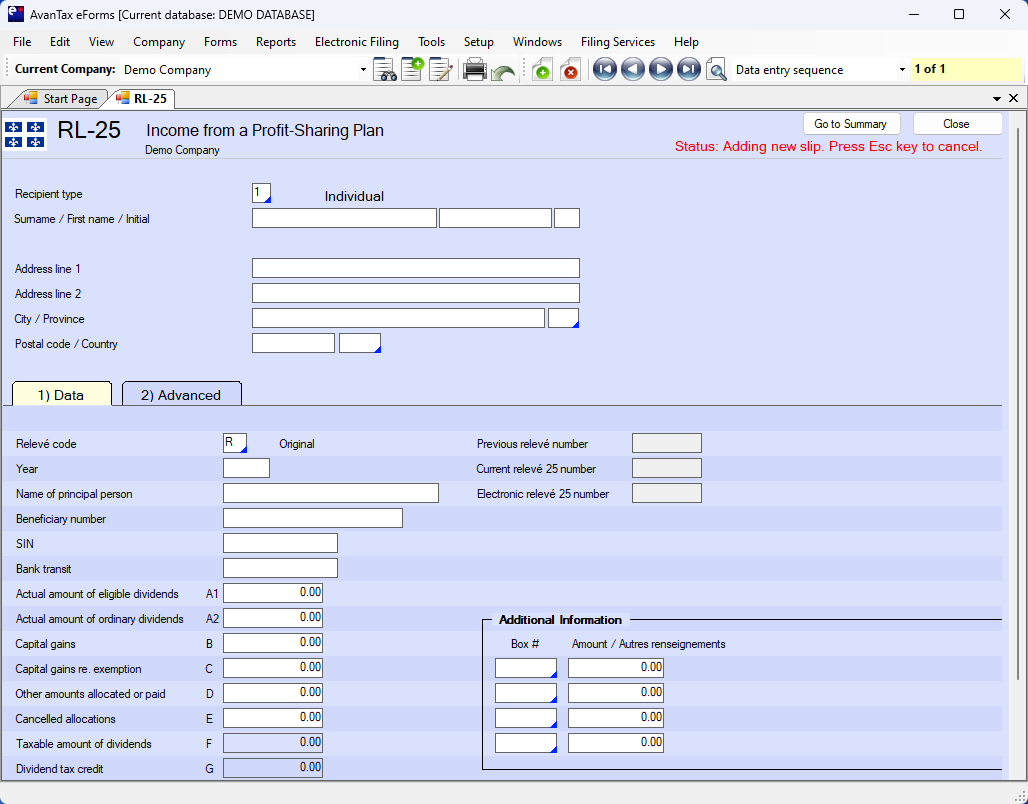

Relevé 25 (RL-25) - Income From a Profit-Sharing Plan

Here's how the AvanTax eForms software can help you prepare your Relevé 25 return:

- User friendly Relevé 25 data entry

- Import Relevé 25 data from CSV, Excel, or Revenu Québec XML submission file*

- Print Relevé 25 slips and summaries on plain paper or Revenu Québec forms

- Create individual Relevé 25 slips (password protected PDF) for electronic distribution**

- Distribute recipient Relevé 25 slips by email or corporate portal**

- Prepare Relevé 25 XML files and upload over Revenu Québec's Internet File Transfer portal

- Easily process original, amended, cancelled and additional Relevé 25 returns

- PLUS!

- Roll forward previous year Relevé 25 data into current year

- Roll forward current year Relevé 25 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

The Relevé 25 slip must be filed by any trustee of a profit-sharing plan to report dividends and capital gains (or losses) allocated to a beneficiary. The beneficiary's employer can file the Relevé 25 slip on the trustee's behalf.

The information on the Relevé 25 slip is used by beneficiaries to complete the personal income tax return (TP-1-V).