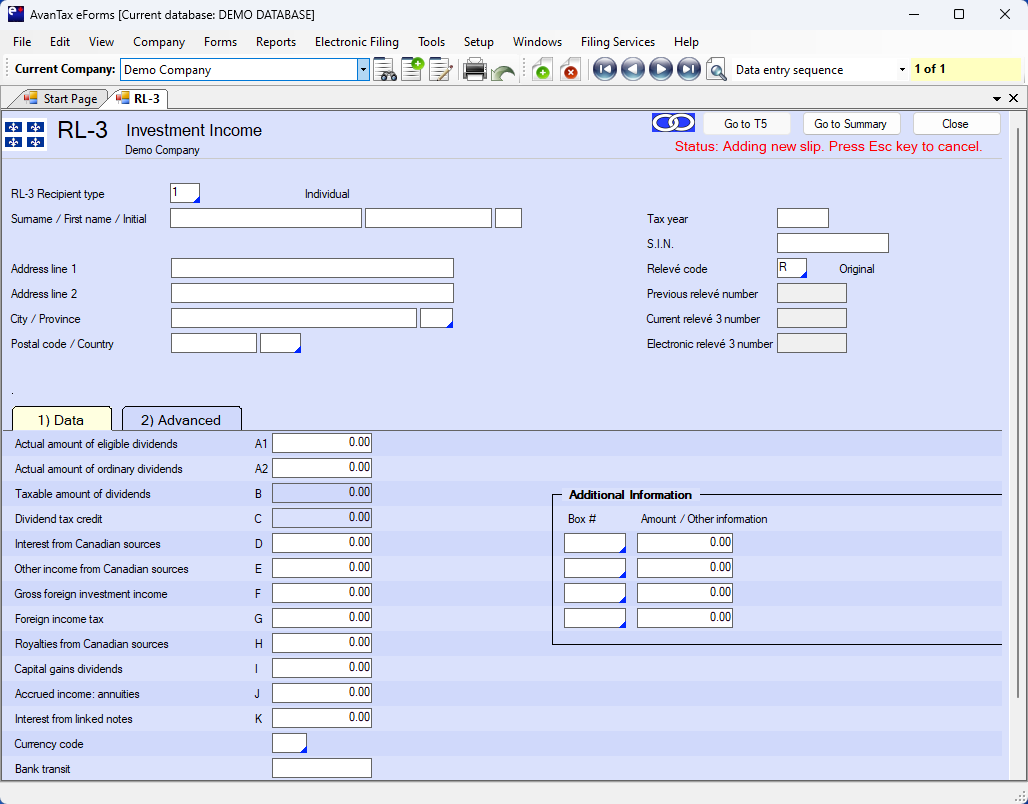

Relevé 3 (RL-3) - Investment Income

Here's how the AvanTax eForms software can help you prepare your Relevé 3 return:

- User friendly Relevé 3 data entry

- Import Relevé 3 data from CSV, Excel, or Revenu Québec XML submission file*

- Print Relevé 3 slips and summaries on plain paper or Revenu Québec forms

- Create individual Relevé 3 slips (password protected PDF) for electronic distribution**

- Distribute recipient Relevé 3 slips by email or corporate portal**

- Prepare Relevé 3 XML files and upload over Revenu Québec's Internet File Transfer portal

- Easily process original, amended, cancelled and additional Relevé 3 returns

- PLUS!

- Roll forward previous year Relevé 3 data into current year

- Roll forward current year Relevé 3 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

The Relevé 3 slip must be filed by any person that paid or credited investment income of $50 or more to a recipient during the year.

The information on the Relevé 3 slip is used by recipients to complete the personal income tax return (TP-1-V), the Déclaration de revenus des sociétés (CO-17), the Partnership Information Return (TP-600-V).