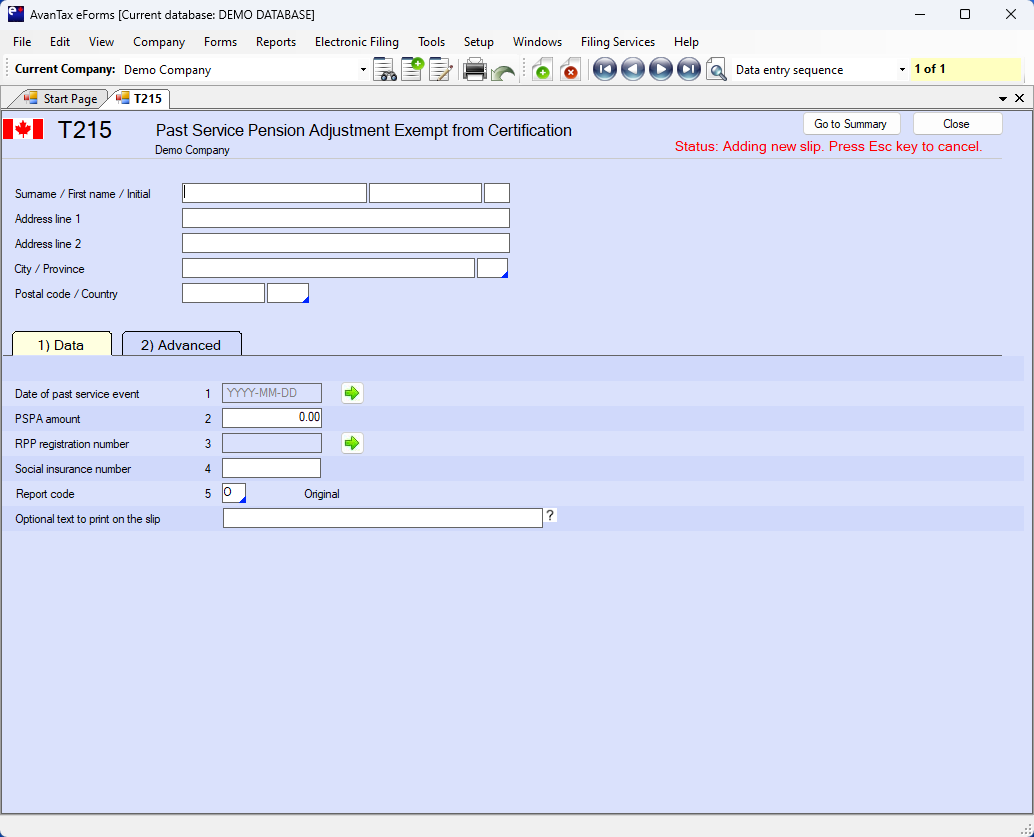

T215 - Past Service Pension Adjustment (PSPA) Exempt from Certification

Here's how the AvanTax eForms software can help you prepare your T215 return:

- User friendly T215 data entry

- Import T215 data from CSV, Excel, or CRA XML submission file*

- Print T215 slips and summaries on plain paper or CRA forms

- Create individual T215 slips (password protected PDF) for electronic distribution**

- Distribute recipient T215 slips by email or corporate portal**

- Prepare T215 XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T215 returns

- PLUS!

- Roll forward previous year T215 data into current year

- Roll forward current year T215 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

A T215 slip must be completed by a plan administrator when the total of the exempt PSPA, or the difference between the original PSPA and amended PSPA, is equal to or greater than $50.