T3 - Trust Information Return

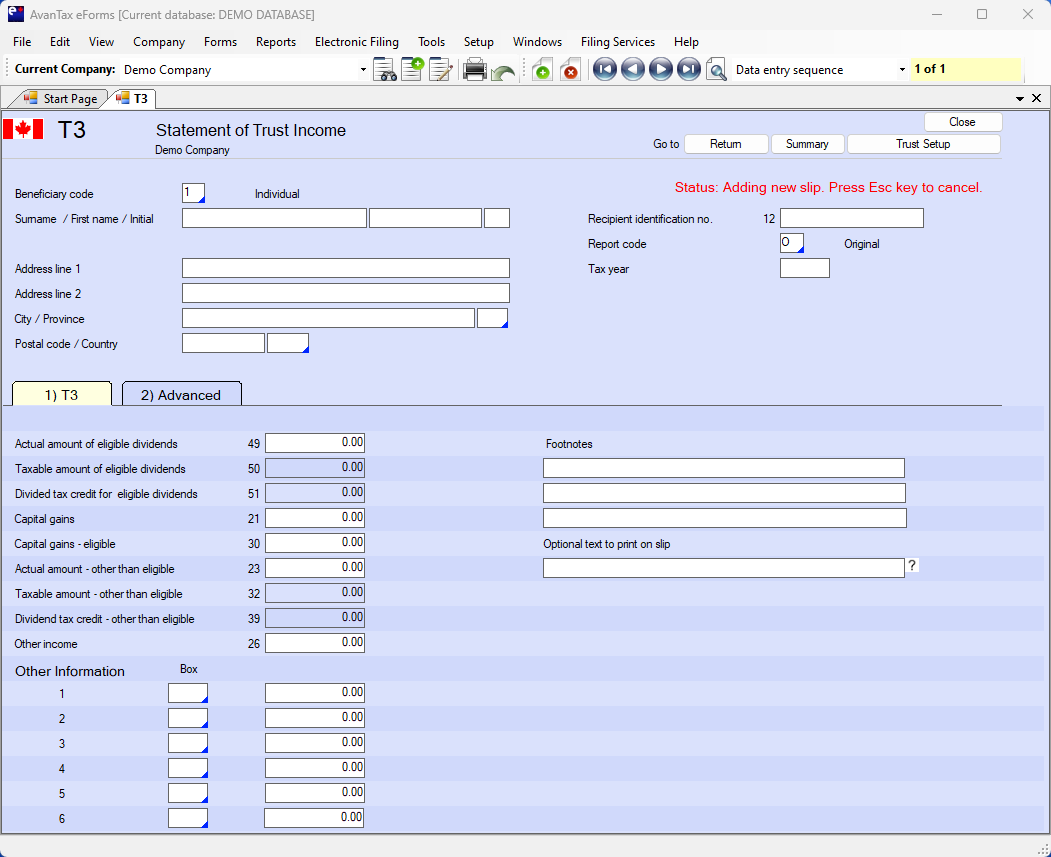

Here's how the AvanTax eForms software can help you prepare your T3 return:

- User friendly T3 data entry

- Import T3 data from CSV, Excel, or CRA XML submission file*

- Print T3 slips and summaries on plain paper or CRA forms

- Create individual T3 slips (password protected PDF) for electronic distribution**

- Distribute recipient T3 slips by email or corporate portal**

- Prepare T3 XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T3 returns

- PLUS!

- Roll forward previous year T3 data into current year

- Roll forward current year T3 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

As trustee, you have to complete a T3 slip, Statement of Trust Income Allocations and Designations, for each resident beneficiary, including a preferred beneficiary, to whom the trust allocated income in the year. You must also do this for a trust that made any distributions of capital that would result in an adjustment to the adjusted cost base of the beneficiary's interest in the trust. If you allocated income to a non-resident beneficiary, see Column 2 – Non-resident.

The T3 slip shows only the high-use boxes (boxes 12, 14, 16, 18, 21, 23, 26, 30, 32, 39, 49, 50 and 51). There are also six generic boxes with blank codes for less common amounts. If you have to use a generic box, enter the box number and the amount in the other information area. If you need more than six boxes for the same beneficiary, use an additional T3 slip.

You do not have to complete a T3 slip for a beneficiary if the income allocated in the year to that beneficiary is less than $100. However, you have to notify the beneficiary of the allocated income since it still has to be reported on the beneficiary's return.

You have to complete a T3 Summary, Summary of Trust Income Allocations and Designations, even if you only prepare one T3 slip. This is the form you use to record the total of the more common amounts you reported on all related slips. File only one summary for the trust, unless it is a mutual fund trust.

Currently AvanTax prepares the four-page Trust Information Return as well as the related T3 Summary and T3 slips. T3 slips can be filed electronically or on paper.

AvanTax eForms can also be used to file the related Relevé 16 with Revenue Quebec.