T4A-NR - Statement of Fees, Commissions, or Other Amounts Paid to Non-Residents for Services Rendered in Canada

Here's how the AvanTax eForms software can help you prepare your T4A-NR return:

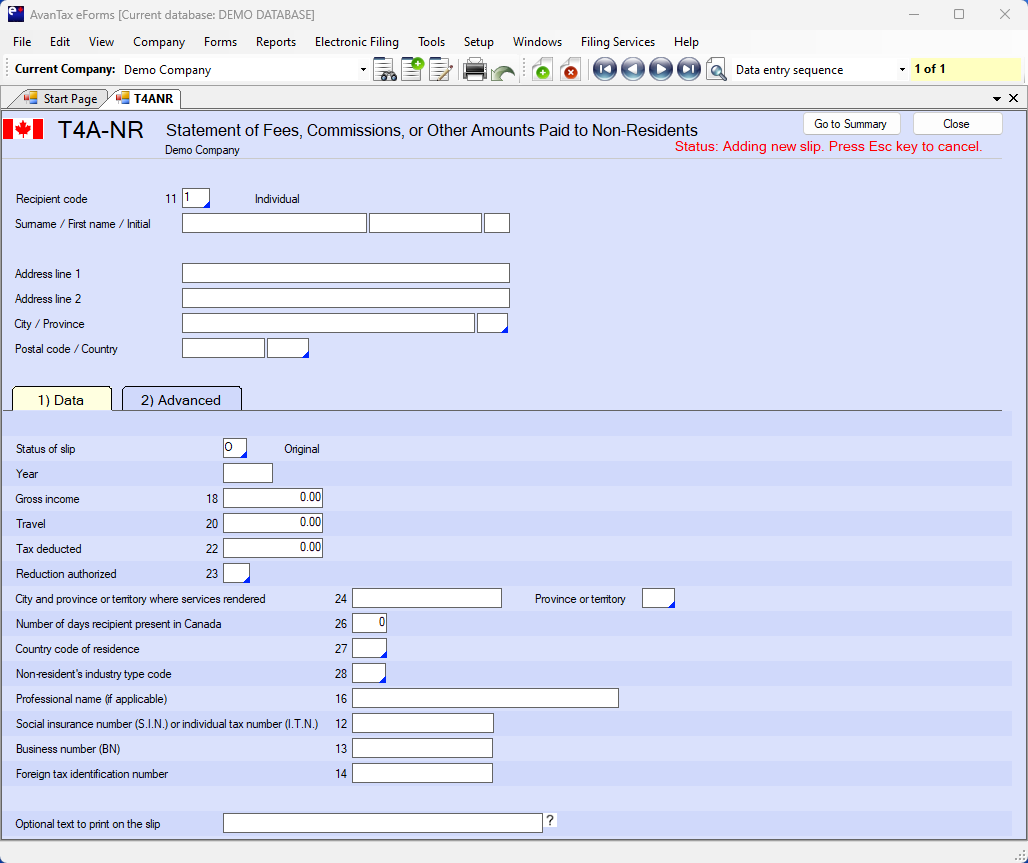

- User friendly T4A-NR data entry

- Import T4A-NR data from CSV, Excel, or CRA XML submission file*

- Print T4A-NR slips and summaries on plain paper or CRA forms

- Create individual T4A-NR slips (password protected PDF) for electronic distribution**

- Distribute recipient T4A-NR slips by email or corporate portal**

- Prepare T4A-NR XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T4A-NR returns

- PLUS!

- Roll forward previous year T4A-NR data into current year

- Roll forward current year T4A-NR data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

Use the T4A-NR slip to report all amounts you paid to non-resident individuals, partnerships, and corporations for services they performed in Canada that they did not perform in the ordinary course of an office or employment.