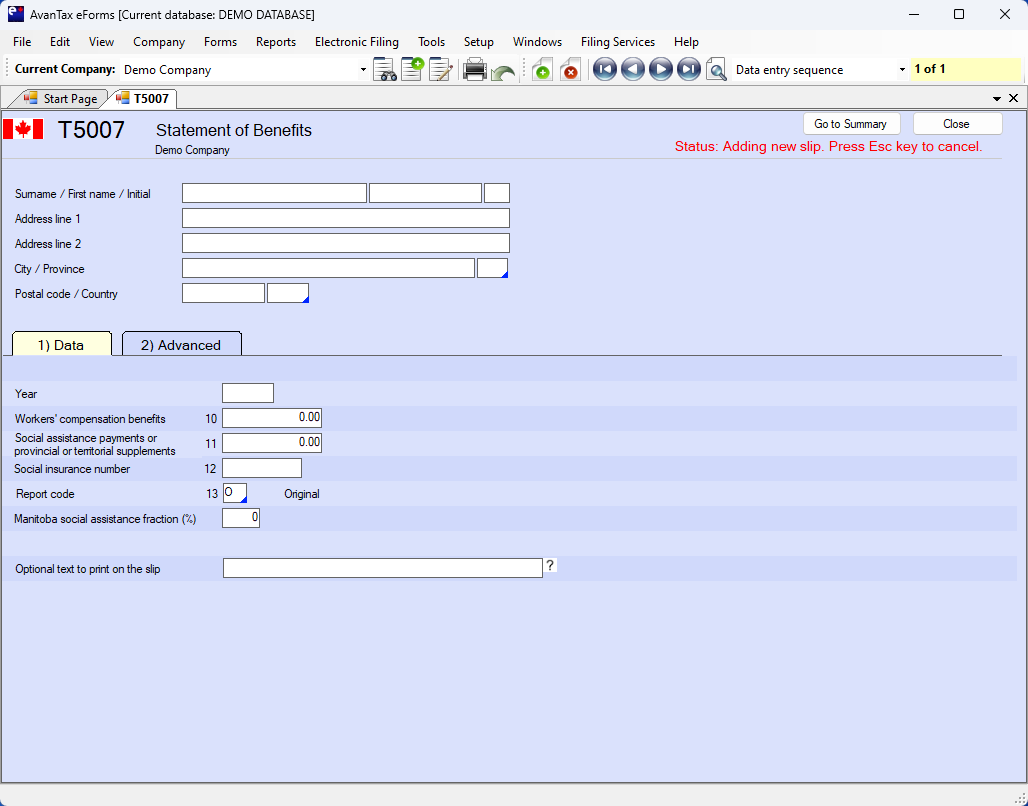

T5007 - Statement of Benefits

Here's how the AvanTax eForms software can help you prepare your T5007 return:

- User friendly T5007 data entry

- Import T5007 data from CSV, Excel, or CRA XML submission file*

- Print T5007 slips and summaries on plain paper or CRA forms

- Create individual T5007 slips (password protected PDF) for electronic distribution**

- Distribute recipient T5007 slips by email or corporate portal**

- Prepare T5007 XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T5007 returns

- PLUS!

- Roll forward previous year T5007 data into current year

- Roll forward current year T5007 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

The following agencies or bodies have to file a T5007 information return:

- any provincial, territorial, or municipal agency or similar body that makes social assistance payments based on a means, needs, or income test; and

- any provincial or territorial workers' compensation board or similar body that pays an amount or determines a claim for compensation under a federal, provincial, or territorial employees' or workers' compensation law for injury, disability, or death.