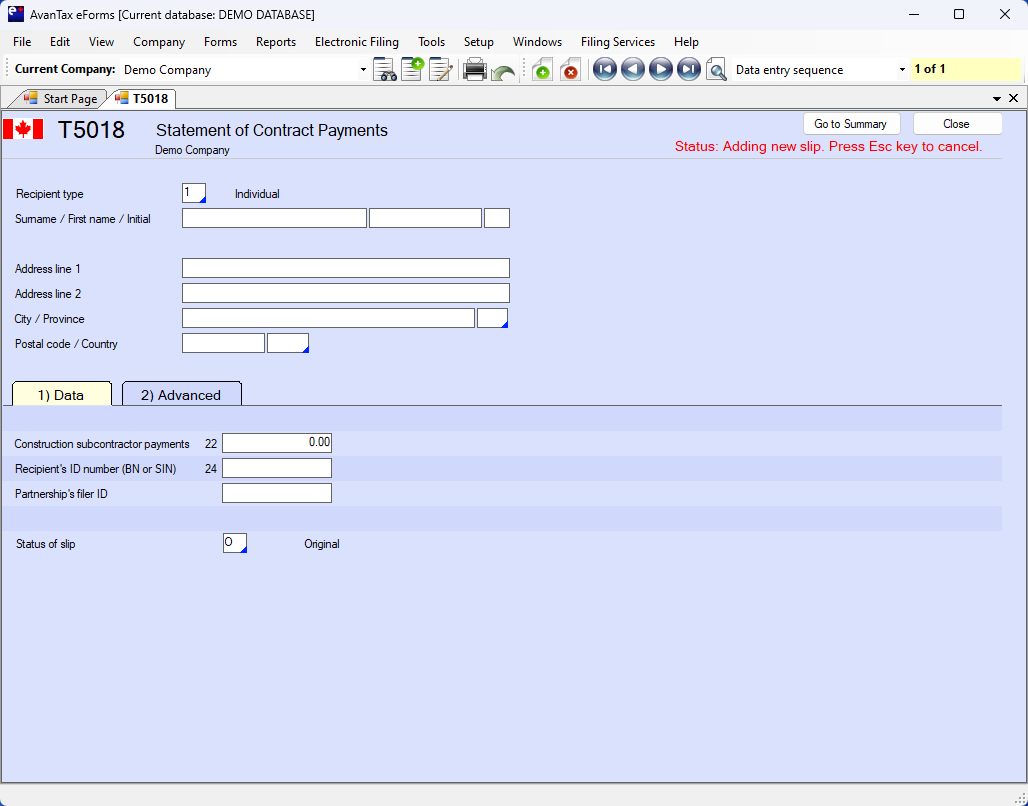

T5018 - Statement of Contract Payments

Here's how the AvanTax eForms software can help you prepare your T5018 return:

- User friendly T5018 data entry

- Import T5018 data from CSV, Excel, or CRA XML submission file*

- Print T5018 slips and summaries on plain paper or CRA forms

- Create individual T5018 slips (password protected PDF) for electronic distribution**

- Distribute recipient T5018 slips by email or corporate portal**

- Prepare T5018 XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T5018 returns

- PLUS!

- Roll forward previous year T5018 data into current year

- Roll forward current year T5018 data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

If you are an individual, partnership, trust, or corporation involved in construction activities which provide your primary source of business income and you make payments to subcontractors for construction services, you must report amounts paid or credited (whether by cheque, cash, barter, or offset against an amount owing).

If more than 50% of a business' income-earning activities are derived from construction, its primary activity is deemed to be construction. In many cases there are businesses which have significant amounts of construction done for them or by them, but this activity is not their principal business and they do not have to report under the Contract Payment Reporting System (CPRS).

The T5018 is part of the Contract Payment Reporting System (CPRS)