Tax-Free Savings Account (TFSA) for Issuers

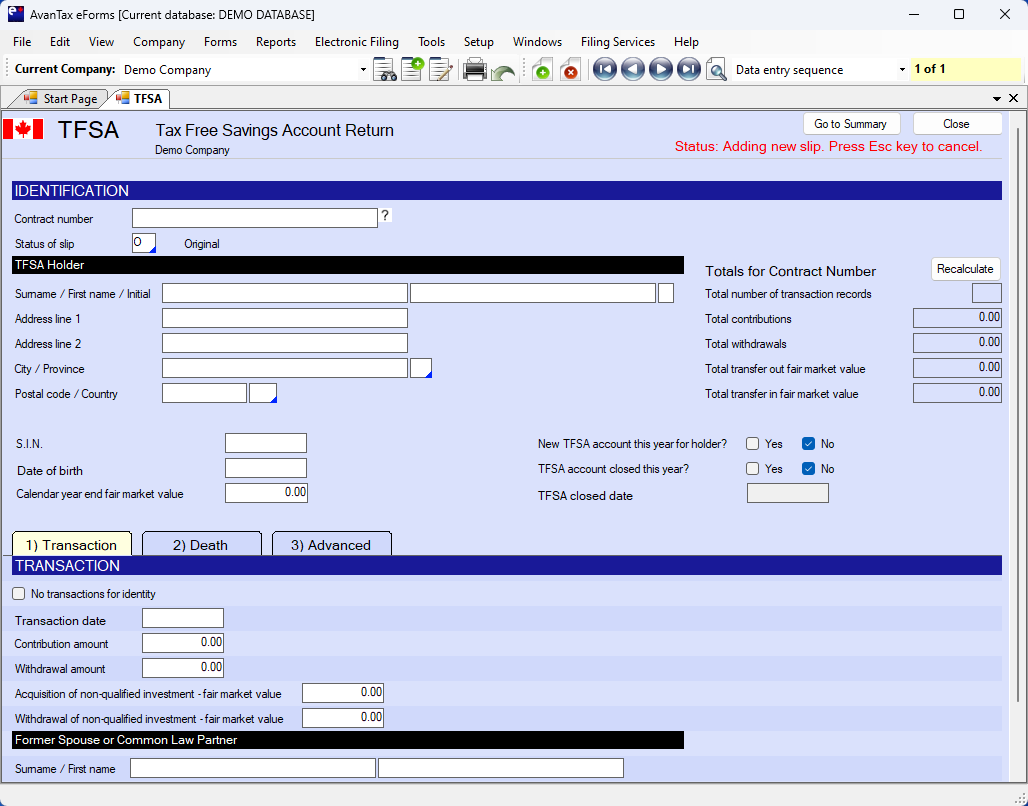

Here's how the AvanTax eForms software can help you prepare the TFSA:

- User friendly TFSA data entry

- Import TFSA data from CSV, Excel, or CRA XML submission file*

- Easily process original, amended, cancelled and additional TFSA returns

- PLUS!

- Roll forward previous year TFSA data into current year

- Roll forward current year TFSA data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

A TFSA annual information return consists of both the TFSA individual records and the TFSA return summary. You have to complete a return for each TFSA identification number under which one or more TFSAs exists at any time in the year. Once a TFSA is opened, an individual record must be filed, regardless of activity in the account. The information (data elements) required in order for us to process each of these forms is described in Appendix A – Data elements – TFSA individual electronic record and Appendix B – Data elements – TFSA return summary.

If a record is filed in one year indicating that a TFSA was opened, we will expect to receive a record for the same TFSA in each year until such time as a record is filed with an indication that the account was closed in the year.

Do not prepare a TFSA individual record if the TFSA was reported as closed in the previous year's TFSA annual information return. We do not consider a TFSA to have been closed just because there are no funds in the account and/or there has been no activity during the reporting year.

Once a TFSA is reported as closed, you cannot reopen it.