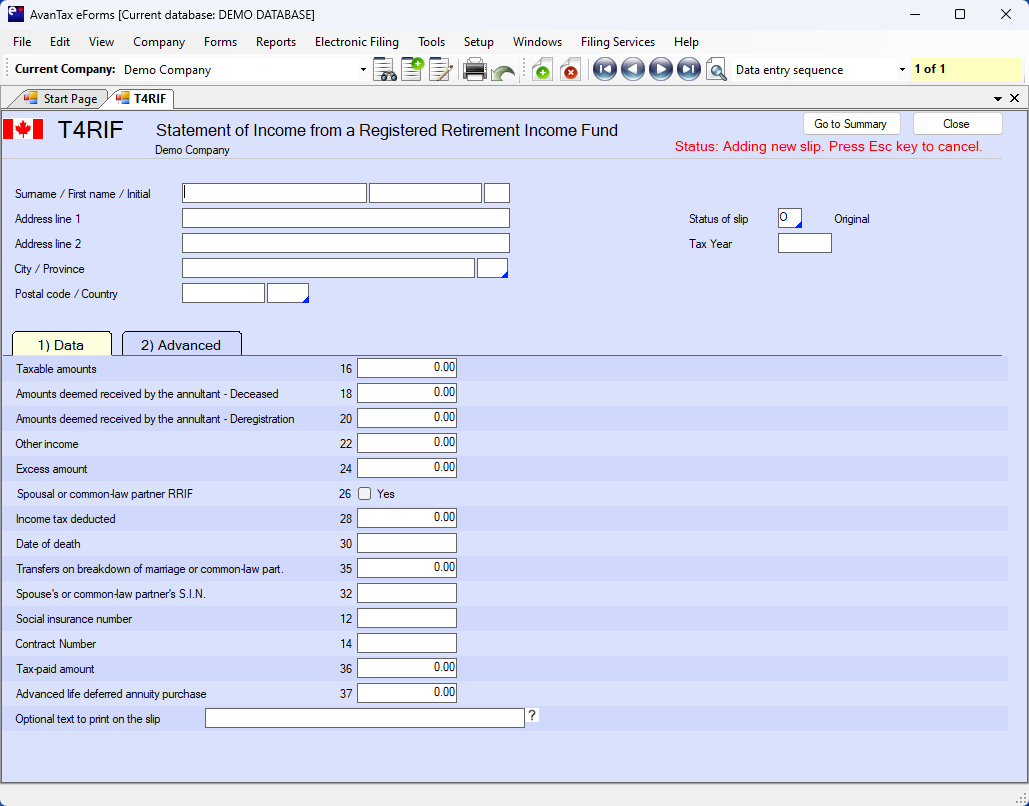

T4RIF - Statement of Income from a Registered Retirement Income Fund

Here's how the AvanTax eForms software can help you prepare your T4RIF return:

- User friendly T4RIF data entry

- Import T4RIF data from CSV, Excel, or CRA XML submission file*

- Print T4RIF slips and summaries on plain paper or CRA forms

- Create individual T4RIF slips (password protected PDF) for electronic distribution**

- Distribute recipient T4RIF slips by email or corporate portal**

- Prepare T4RIF XML files and upload over CRA's Internet File Transfer portal

- Easily process original, amended, cancelled and additional T4RIF returns

- PLUS!

- Roll forward previous year T4RIF data into current year

- Roll forward current year T4RIF data into following year

- Unlimited technical support by phone, email or live chat

- and much more!

* eForms Standard & Enterprise

** eForms Enterprise

Use the T4RSP and T4RIF information returns to report amounts from an RRSP or a RRIF that residents of Canada have to include in or can deduct from their income. Use the T4RSP information return to report amounts residents must include on Schedule 7, RRSP and PRPP Unused Contributions, Transfers, and HBP or LLP Activities. For information about payments to non-residents of Canada, see Chapter 7 – Payments to non-residents of Canada.

To prepare a T4RSP or a T4RIF information return, you must complete the T4RSP or T4RIF slips and the related summary.

Slip – Use the slip to report amounts that an individual has to report on his or her income tax and benefit return or on Schedule 7, RRSP and PRPP Unused Contributions, Transfers, and HBP or LLP Activities. For information on how to complete the T4RSP and the T4RIF slips, see Chapter 3 – How to complete the T4RSP and T4RIF slips. See a sample of the T4RSP and T4RIF.

Summary – Use the summary to record the total amount you reported on all related slips. For information on how to complete the summary, see Completing the T4RSP and T4RIF Summary. See a sample of the T4RSP Summary and the T4RIF Summary.